Bank Reconciliation

The bank reconciliation allows you to truly stay on top of the bank account and reconcile checks, deposits, all types of transactions on a daily basis.

System Maintenance

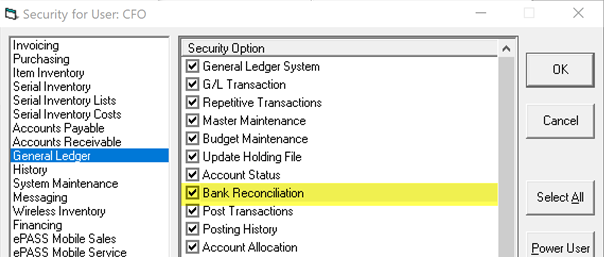

User Security

A security has been added for Bank Reconciliation.

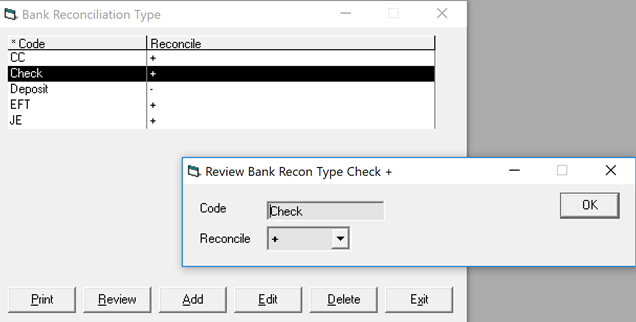

Bank Reconciliation Type

The Bank Reconciliation Type is where we define each transaction we see on the bank rec. This allows you to group these transactions, identify them easier, and it also indicates to EPASS if the transaction needs to be added or subtracted from the bank balance to aid in balancing. Example: Checks that have not cleared need to be added back into the EPASS bank balance to make you balance to the bank statement.

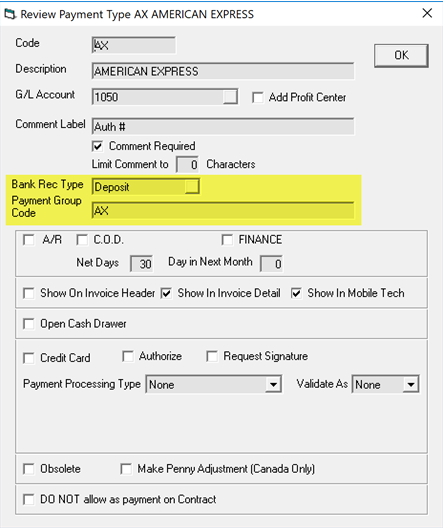

Payment Group

The Payment Type table has two properties to be filled in; Bank Rec Type along with Payment Group Code. These two properties work together on both the bank reconciliation and also on the AR posting.

The Bank Rec Type is combined with the Payment Group Code to make it easily identifiable; ‘Deposit’ is combined with ‘AX’ so you will be able to identify this deposit as an Amex. Quite a few clients will have Visa, Mastercard and Discover all deposit as one total on their bank statement; in that case, you would want to setup all three payment types as having the same ‘Payment Group Code’.

By setting up Visa, MC, and Discover all with Payment Group Code ‘CC' (as above), they will all be grouped as one combined total on the AR posting and the bank reconciliation. Since they are being deposited into the bank by your credit card processor as one total, you will benefit by seeing them as one total on the bank rec.

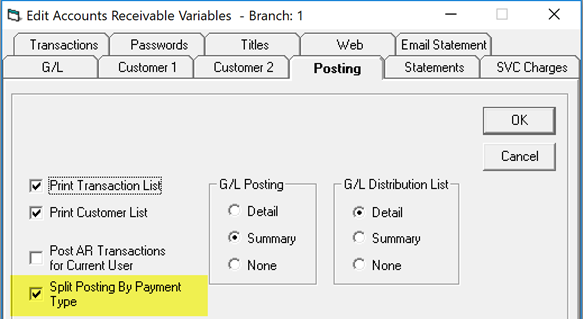

Accounts Receivable Variables

You must enable Split Posting By Payment Type for the grouping by Payment Group Code as described above to happen.

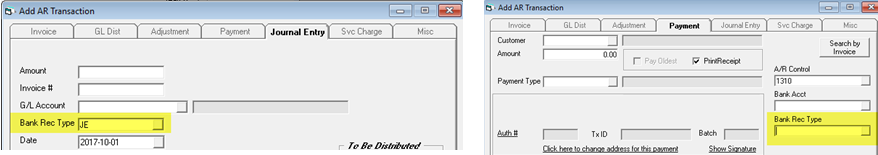

Transactions

AR Transactions: Add Payment and JE both have a Bank Rec Type field you can select:

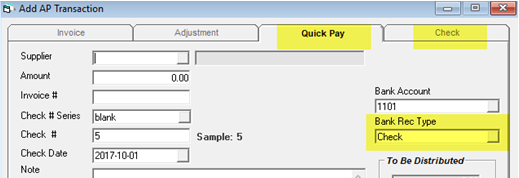

AP Transactions: Quick Pay and Check also have a Bank Rec Type field you can select:

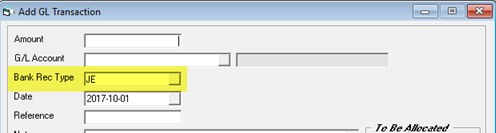

GL Transactions: Journal Entry has the same:

All of these flow to the GL Bank Reconciliation.

Reconciliation

It is important to clarify that the AP Check Reconciliation is still available and can be used in conjunction with the GL Bank Reconciliation. Reconciling a check in one system also reconciles it in the other system. You may have an AP clerk with lower security that you do not want to have access to the GL. This way they can reconcile the checks that have cleared but they cannot access the rest of the Bank Reconciliation.

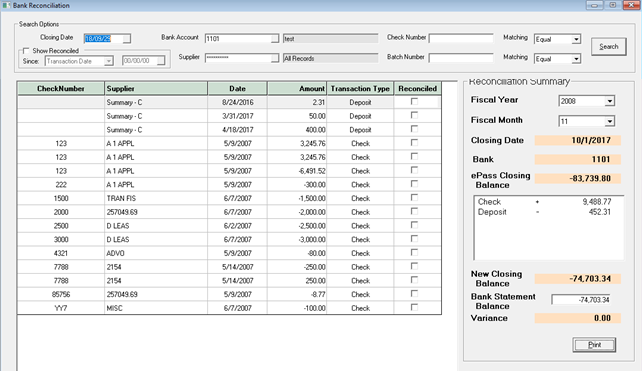

At the top of the screen, you fill in the closing date along with the bank account. On the lower right, you fill in the bank statement balance. When you click Search, all the transactions will be shown. The main part of the screen shows the transactions waiting to be reconciled and the right side of the screen shows your bank balance as compared to your bank statement.

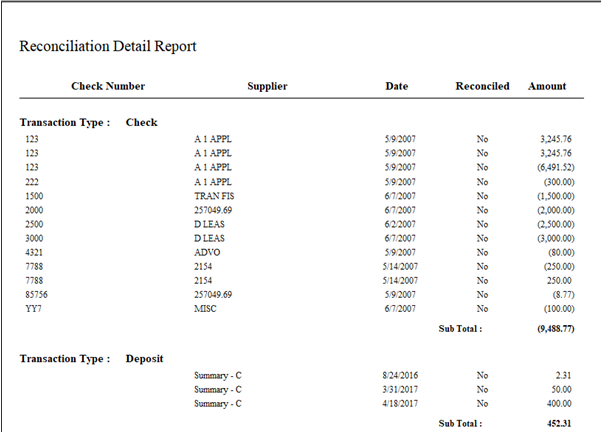

Notice the first three entries show ‘Summary – C’. This is the ‘Payment Group Code’ as setup in the Payment Type table.

The transaction type can be changed, if needed, along with the reconciled checkbox. As transactions are marked reconciled, the totals on the right will adjust.

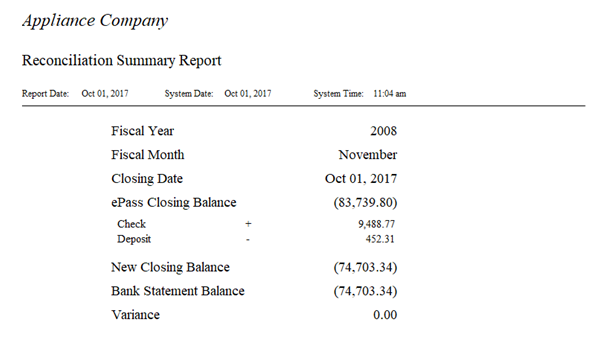

The Print button, on the lower right, will print out a bank reconciliation summary along with the detail of the transactions that made up the difference.